On Tax Day, the U.S. Chamber Pretends the Trump Tax Cut is Not Just for the Very Wealthy

This morning, the U.S. Chamber of Commerce held its “Tax Cuts at Work” event to celebrate the tax legislation that passed in December, which gave a massive windfall to the wealthy and to profitable corporations, as well as rewarding tax dodgers that had stockpiled money overseas. The event description states that attendees gathered to “discuss the benefits of the recently enacted tax reform legislation,” which is code for a lot of self-congratulatory back-patting since the Chamber lobbied heavily for its passage. In fact, a recent Public Citizen report found that the Chamber hired 115 lobbyists on tax issues in 2017—the most hired by any one organization.

This Chamber event is part of a coordinated PR blitz that President Trump, the GOP leadership, and their cronies have been engaged in since the bill’s passage that would have the American public believe tax cuts for corporations actually spur wage growth and job creation. Not only has trickle-down theory been disproven in the past, but the current data show that almost all of the real effects of the tax cut involve making the extremely wealthy even wealthier. That’s why people call it the Trump Tax Scam.

In a recent blog post, the Chamber trumpeted that because of the new tax law, “job creators are sending less of their hard-earned money to Washington,” which of course means there will be less revenue for healthcare, education, and other important government investments like infrastructure. However, the post also gave the false impression that it is primarily small businesses that are seeing the tax cuts’ benefits rather than giant corporations. The reality is that the tax cut’s benefits for small business owners are complicated and confusing, and has different treatment for different types of small businesses, meaning some could possibly end up paying more.

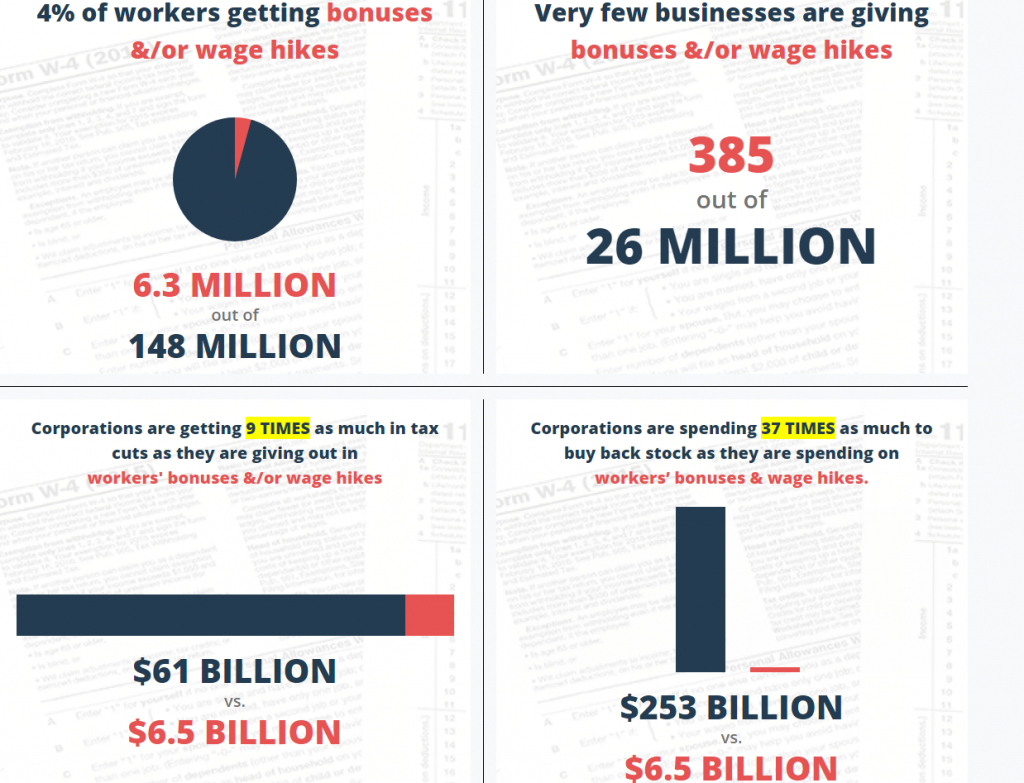

The newly-launched resource, Trump Tax Cut Truths, makes clear where the money from the tax cuts is actually going. The answer? To giant corporations and the extremely wealthy, mostly. Take a look at some key findings:

Graphic: Americans for Tax Fairness

The Chamber’s public relations materials may be able to cherry-pick anecdotes of a couple of small business owners whose stories suit its narrative of reinvestment, but it’s plain to see that the overwhelming bulk of the tax cut’s benefits are going to shareholders, not workers. The stock buybacks and higher corporate profits mean very little to the average employee. A recent National Bureau of Economic Research report found that the majority of U.S. households own no stock, the richest 1% own 40% of stock, and the richest 10% own 84% of stock.

Previously, we wrote about the Chamber’s million dollar ad campaign and its “Tax Reform Now” website, back when the Chamber was lobbying the get the tax cut package passed. Both of those promotion efforts were deeply misleading in exactly the same way as its current messaging around the tax scam: pretending it was about helping working people and small businesses, rather than the corporations and Big Business executives it was created to benefit.

This law is having exactly the effect it was designed to have: making Donald Trump and his family, Republicans in Congress, and their billionaire donors richer. A recent report from the Institute of Taxation and Economic Policy found that the richest fifth of Americans will receive 71% of the benefits of the tax law in 2018, with the largest benefit going to the richest one percent. The U.S. Chamber can try all it wants to hide that fact, but the numbers don’t lie.

Instead of letting ourselves fall for the Chamber’s misleading portrayal of what the tax changes have actually done, we should end tax breaks for wealthy CEOs and reject efforts by the GOP to pay for their charade by making deep cuts into Social Security, Medicare, Medicaid and education. Take action today to demand that Congress repeal the #TrumpTaxScam.