The U.S. Chamber’s Plans to Defang the CFPB

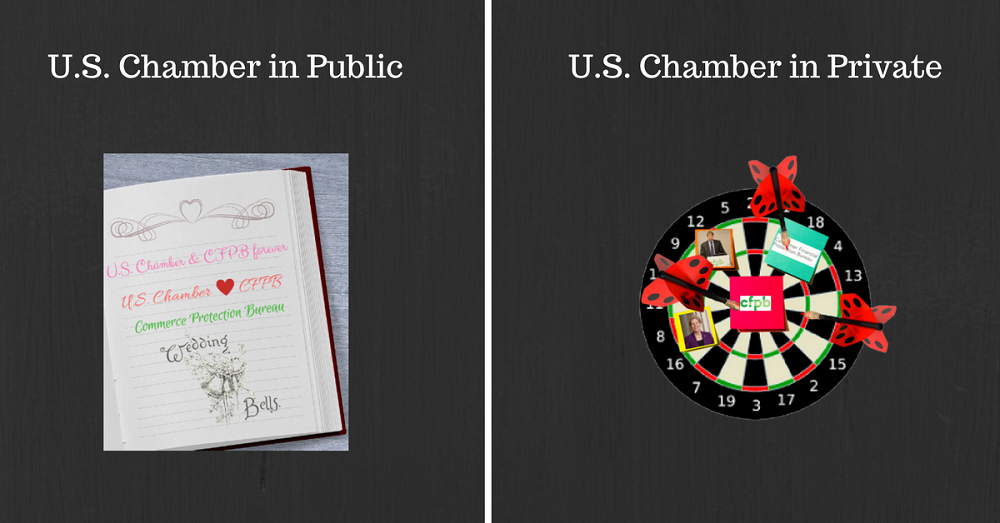

The U.S. Chamber of Commerce really, really does not like the idea of an independent and effective Consumer Financial Protection bureau (CFPB).

That’s the key takeaway from its recently-released CFPB “reform” agenda. The agenda’s preamble claims that the Chamber’s proposed restructuring is “an effort to support the agency’s mission to protect consumers,” but a look into their proposals shows that this is mere smoke and mirrors. The Chamber’s true goal is to defang the CFPB and roll back consumer protections.

The Chamber’s recommendations would drastically change the way the bureau does its work—mainly by stripping the agency of its independent leadership and funding. And, other proposed changes would threaten the public’s access to information, weaken the bureau’s system for citizens to make complaints about specific companies, and would put less emphasis on enforcement.

Currently, the CFPB’s funding is handled by the Federal Reserve. That was deliberate in design; the CFPB must be independent from Congress in order to ensure that it represents consumers first and can’t be guided toward partisan ends. The Chamber’s proposal would put Congress in charge of the CFPB’s purse strings, allowing the congressional majority to control the bureau’s funding in a way that will effectively keep it from issuing safeguards to protect consumers.

The Chamber’s agenda also recommends changing the structure of the CFPB to be run by a bipartisan commission, so that, like other commissions, partisan fighting could stop the bureau from implementing new protections. The current structure has worked well and has been upheld by the courts—a federal appeals court ruled in January that the single-director structure of the bureau is constitutional and that the director cannot be fired by the president without cause. As with bringing the bureau’s funding under congressional control, this measure is designed to allow the Chamber’s friends in the GOP to prevent the bureau from exercising meaningful regulation of financial institutions involved in predatory or abusive practices.

Critically, the Chamber’s stance on the CFPB very closely mirrors that of the Trump administration. Recently, the CFPB released its semi-annual report, the first under Acting Director Mick Mulvaney, a Trump loyalist and House Freedom Caucus co-founder who has previously called the bureau a “sad, sick joke.” As Public Citizen has documented, Mulvaney’s report is essentially a roadmap for the dismantling of the CFPB that Mulvaney has desired for a long time. The CFPB’s report includes Mulvaney’s four recommendations for Congress to gut the bureau and render it ineffective. Like the Chamber’s recommendations, Mulvaney’s proposal includes provisions to make the CFPB’s budget subject to appropriations from Congress. As Lisa Gilbert, Public Citizen’s vice president of legislative affairs, put it, Mulvaney’s proposals are a “knife in the heart” of the CFPB.

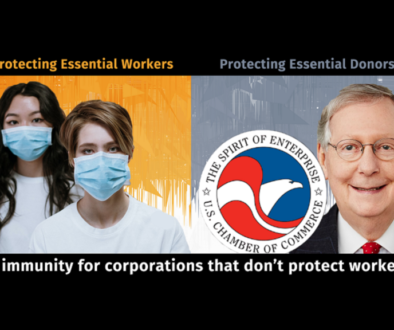

Throughout its agenda, the Chamber hides its intentions behind PR-friendly buzzwords like “access,” “choice,” and “reform.” But scrutiny of the Chamber’s proposals makes it clear that what they really want is to let corporations escape oversight and accountability, and to let an overly partisan and corporate captured Congress keep the CFPB from making real advancements for consumers.

The value of the CFPB to American consumers cannot be overstated. As of early 2017, the bureau had secured nearly $12 billion in relief for nearly 30 million consumers. It had also handled over 1 million complaints, and fielded questions from the 13 million unique visitors to its Ask CFPB tool.

But the bureau’s independence from Congress and partisan politics is essential to its effectiveness. Only free from Congress’ control can the CFPB put the needs of the American people ahead of interference from an uncooperative majority focused on putting the needs of their corporate donors first.

Rather than allow the CFPB to continue its essential work to protect consumers, the U.S. Chamber of Commerce would instead like for its Big Bank friends have what they’ve been clamoring for: an end to the bureau’s independence and control over its actions. After all, when you represent predatory Wall Street banks, you can’t just let some watchdog agency stop you from lining your own pockets, no matter how much harm you do to consumers.

But, we will continue to work to stop the Chamber and the Trump administration from getting their way. We’ll defend the CFPB against restructuring that would prevent it from doing its job: to ensure people, not bank profits, are protected. Take action today to stand with us.