U.S. Chamber Tax “Reform” Won’t Help Working Americans

Three things in life are certain: death, taxes, and the U.S. Chamber of Commerce pushing for massive tax cuts for giant corporations and the managerial elite. In a new million dollar ad campaign launched last week, the Chamber depicts average Americans at work, whether behind a cash register or on a factory floor, while the words “create jobs,” “families,” and “the American dream” flash across the screen. In each of these ads, the speakers demand “tax reform,” without ever really specifying what that means. It all seems innocent enough, and could easily fool viewers unfamiliar with the Chamber. But make no mistake, dig down, and the Chamber isn’t interested in tax policies that will invest in Main Street businesses and working Americans; it wants huge cuts for its corporate membership and the ultra-wealthy who run and own these companies. The Chamber’s new ad campaign is just the group’s latest attempt to advance a Big Business agenda by pretending that it would help working people and small businesses.

So how exactly is the Chamber proposing to change our tax code? Its “Tax Reform Now” website is remarkably devoid of specifics, limiting itself to calling for “pro-growth” tax reform. “Pro-growth” is Chamber-speak for trickle-down economics: cut taxes on corporations and the wealthy and employment and wage growth will magically appear. (Of course, the data prove trickle-down to be nothing more than a right-wing fantasy.)

The Chamber’s new ad campaign doesn’t offer many specifics either. The ads may call for closing loopholes, but the Chamber fails to mention exactly which loopholes.

If you want to really understand what the Chamber wants to get out of tax “reform,” you have to look at the group’s history of lobbying for a bevy of tax giveaways for giant corporations and the ultra-rich. Let’s take, for example, the subject of closing loopholes, mentioned in the Chamber’s ads. Unfortunately, it doesn’t seem likely that one of the loopholes the Chamber wants closed is the CEO Bonus loophole, which allows companies to exploit a quirk in the law and give their CEOs multimillion-dollar bonuses and deduct this amount from their taxable income. This loophole effectively subsidizes already out of control executive pay while increasing the incentives for excessive risk-taking, and it costs taxpayers an estimated $5 billion a year!

Nor are we holding our breath waiting for the Chamber to demand that the carried-interest loophole be closed, given that they have supported retaining the loophole in the past. This loophole allows hedge fund and private equity fund managers to claim part of what is really salaried income as capital gains instead, which allows them to pay only a 20 percent tax rate as opposed to the 39.6 percent income tax they likely otherwise would pay. This loophole benefits only 2,000 taxpayers yet it is blowing a hole in the budget, estimated at around $2 billion per year.

While the Chamber at least mentions closing loopholes in its ads, there are lots of things it doesn’t mention, probably because they benefit corporations and the wealthy and not the working people featured in the ads. Let’s start with the Chamber’s supportfor a rate cut for “pass-through” businesses (companies that file taxes through the owners’ individual taxes versus paying corporate tax.) Such a rate cut would disproportionately benefit the wealthy.

While the Chamber may claim that cutting the tax rate on pass-through enterprises would benefit small businesses, more than 70 percent of filers with pass-through income already pay rates at or below 15 percent, meaning they would see no benefit from the proposal. The vast majority of this tax cut will really go to the Chamber’s millionaire and billionaire allies, not to mom and pop shops. What’s more, real small businesses may be hurt because big tax cuts may result in big spending cuts, thereby reducing funding for services vital to Main Street businesses, including investment in infrastructure, education, and assistance for small businesses.

Another item on the Chamber’s tax cut wish list is abolishing the estate tax. The Chamber has been a staunch opponent of the estate tax for years, claiming that it harms family businesses, though that’s plainly not true. Under the current rules, the estate tax only applies to estates valued at more than is $5.49 million and $10.98 million per couple. Estimates show that only 50 small farms and small business estates in all of the United States are likely to pay estate tax in 2017.

The Chamber has argued time and time again that tax “reform” must include cutting the corporate tax rate. The Chamber loves to claim that our taxes are the highest in the developed world, and argues that by making America’s corporate tax rate competitive with the rest of the world, jobs will be kept in America. What the Chamber fails to mention is that the effective rate companies pay in the U.S. is actually much lower (18.6 percent on average, with some industries like gas and electric companies paying a rate in the low single digits). What’s more, many wealthy corporations frequently get away with paying no federal income taxes. And a recent study has shown that companies that pay lower effective rates have actually reduced employment while companies that pay higher effective rates have added employment. Slashing the corporate tax rate as the Chamber wants will pad the pockets of CEOs and rich stockholders, while doing very little to spur investment or create jobs.

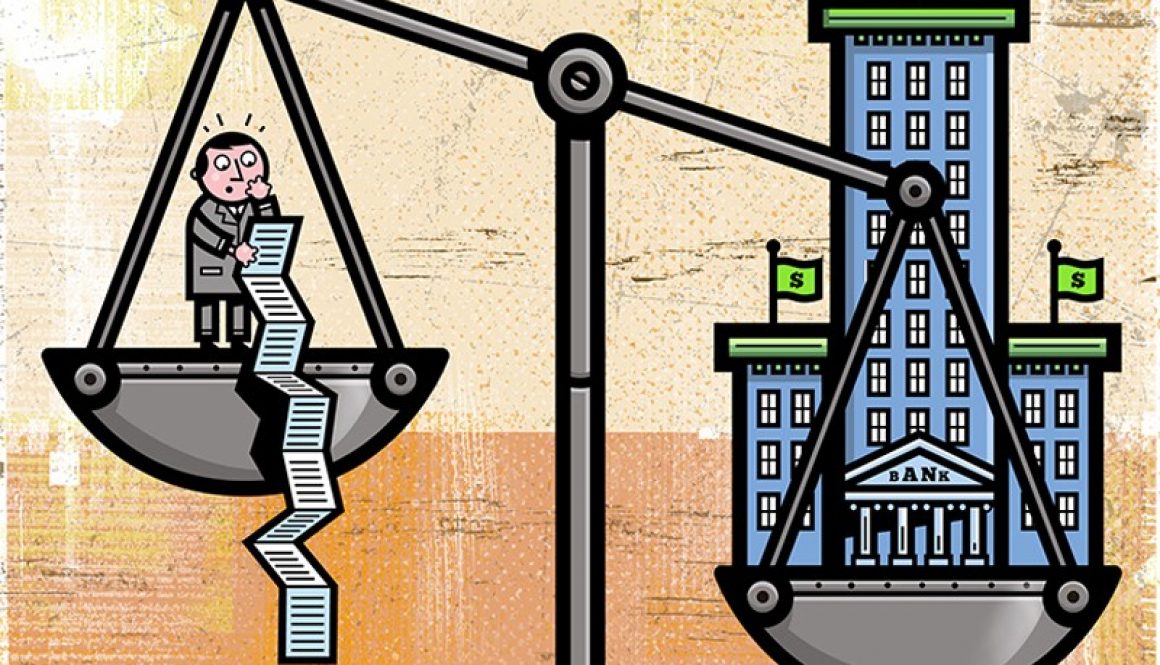

The tax code changes championed by the Chamber and seemingly agreed to by Trump and the GOP are rigged in favor of billionaires and big corporations – they constitute a massive tax giveaway to the super rich and a payback scheme for the Chamber’s big business members.

So don’t believe those Chamber ads you may see on TV – the Chamber’s version of tax ”reform” won’t help the working Americans featured in the ads, but it would line the pockets of the corporations and oligarchs who least need a tax cut.