Who Will Chamber Side With in Wells Fargo vs. Mom & Pop Shops?

Wells Fargo has done it again. And again. And again. This time, instead of creating fake accounts that customers weren’t aware of, or allegedly charging them for auto insurance they didn’t need, Wells Fargo has come for the mom and pop shops of Main Street, USA.

A new class action lawsuit alleges that Wells Fargo has been overcharging small businesses for processing credit card transactions, asserting that Wells’ 63-page Merchant Processing Application included “voluminous legalese that could not possibly be read in its entirety or understood by merchant customers.” The suit claims that various fine print provisions allowed the bank to charge merchants arbitrary fees.

According to the suit, one of the plaintiffs in the case, a small business owner in Charlotte, was charged monthly fees for failing to meet a minimum number of transactions, a minimum he believed had been waived. Another plaintiff, a Pennsylvania small business owner, claims he was charged numerous additional fees including monthly charges even after his business closed. In each case, fine print clauses in the contract were used to justify the imposition of these additional fees.

This case is yet another example of Wells Fargo using fine print to rip off its customers, be they individual consumers or small businesses. In the fake account scandal, Wells continuously used forced arbitration clauses buried in fine print to block class actions challenging its improper behavior. These “rip-off” clauses, commonly found in contracts for a variety of financial products such as banks accounts, credit cards, and loans, ban individuals and small businesses from banding together and challenging wrongdoing in court.

Instead of litigating allegations of fraud and other abusive practices in court before a neutral judge, banks like Wells Fargo can force consumers and small businesses into an individual and secretive arbitration process where the arbitrator who will hear the case is a person chosen by the financial institution. By robbing defrauded customers of their day in court, financial institutions are able to get away with widespread misconduct, because few people have the time or resources to pursue often small dollar claims alone in secret arbitration.

While much of the Wells coverage to date has been heavily focused on defrauded consumers, rip-off clauses harm small businesses as well, making it nearly impossible for small business owners to protest hidden fees, illegal debt collection, and other deceptive or unfair practices. Almost any time a mom and pop store does business with a financial services company, chances are the contract contains a rip-off clause. Nearly all credit card agreements force customers into arbitration if there is a dispute – and credit cards are one of the top three sources of short term capital used by small businesses.

It seems probable that this latest case will end up being another instance in which Wells will attempt to use forced arbitration as a “get out of jail free” card.

Fortunately, a newly released rule from the Consumer Financial Protection Bureau (CFPB) will prohibit banks and lenders that break the law from stripping consumers of the right to join together and hold these institutions accountable in class action lawsuits. Small businesses that use consumer financial products will also be protected by this rule.

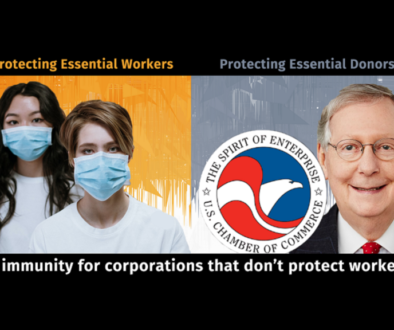

That’s the good news. Now the bad news. The U.S. Chamber of Commerce, the country’s most powerful business lobby, is already pushing Congress to kill the rule and rob consumers of the ability to join together to hold banks accountable in court for wrongdoing. Without the CFPB arbitration rule, Wells Fargo and other financial services companies will continue to pocket billions in ill-gotten gains at the expense of consumers and small businesses. This new rule will restore accountability and transparency, making our financial system stronger and safer for all of us.

The Chamber has a tough choice to make. On the one hand, it has lobbied extensively against limits on rip-off clauses and is now is urging Republicans in Congress to repeal the rule under the Congressional Review Act. On the other, it repeatedly claims to be the voice of small business.

So, when the rubber meets the road, will the Chamber continue lobbying to give a free pass to institutions like Wells Fargo, or will it stand up for the small businesses it claims to represent in its promotional materials? If the Chamber really is the voice of small of business, then this latest case against Wells Fargo presents a perfect opportunity for the Chamber to put its money where its mouth is. The Chamber should take a stand on behalf of mom and pop shops by ceasing to defend the rip-off clauses big banks use to take advantage of small businesses. Otherwise, it’s simply defending corporate greed.