Chamber’s Defense of Forced Arbitration Falls Apart

On Tuesday, the Senate Banking Committee held a hearing that was ostensibly supposed to “assess the effects of consumer finance regulations.” Unfortunately, instead of actually attempting to assess the effects of these regulations, the committee’s Republican leadership seemed far more interested in conducting a show trial of the Consumer Financial Protection Bureau (CFPB), the agency created in the aftermath of the regulatory failures that allowed the 2008 financial crisis to occur.

Even a show trial needs a few witnesses, and the leadership obliged, putting together a panel of four witnesses, three of whom represented the interests of the financial services sector, whose predatory lending practices and rampant speculation caused the financial crisis and whose consumer credit activities are now regulated by the CFPB. Big banks, predatory payday lenders, credit card issuers, and mortgage lenders don’t particularly like the CFPB because it has drastically curtailed shady and dishonest practices in the industry, in the process saving consumers $20 billion in credit card fees alone.

True to form, the three banking industry witnesses all denounced the CFPB. First up was Leonard Chanin, once an official at the Federal Reserve and now a poster boy for the revolving door in his role as counsel to banks at a large corporate law firm. Mr. Chanin might best be qualified as a see no evil, hear no evil witness, since he claimed that the Federal Reserve had no warning of the subprime mortgage crisis. This prompted an incredulous Senator Elizabeth Warren (D-Mass.) to ask if he had his “eyes stitched shut.”

Last to testify was Todd Zywicki, a law professor at George Mason University which, quelle surprise, just happens to receive tens of millions of dollars from the Koch brothers. Even more troubling was Mr. Zywicki’s testimony that he doesn’t represent the banks’ interests, despite working as a director at a consultancy that has done major work for Visa, Bank of America, and Citigroup. Such a blatant conflict of interest does little to inspire confidence in the reliability of Mr. Zywicki’s testimony.

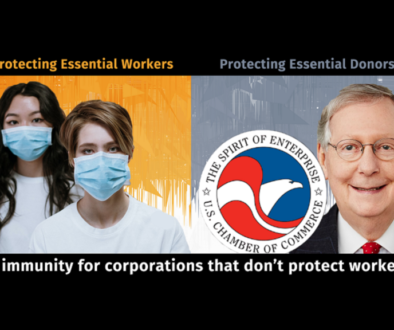

And then of course in the middle there was David Hirschmann, president of the U.S. Chamber of Commerce’s Center for Capital Market Competitiveness. The Chamber has a long history of doing the Big Banks’ dirty work for them, and indeed was central to the lobbying campaign to kill the Dodd-Frank Wall Street Reform Act. Six years may have passed since the passage of Dodd-Frank, but the Chamber still has it out for the CFPB, whose creation was a signature achievement of Dodd-Frank.

Central to Mr. Hirschmann’s testimony was an attack on an expected CFPB rulemaking seeking to limit the use of forced arbitration in contracts for consumer lending products. Forced arbitration is commonly found in contracts for credit cards, bank accounts, and other consumer financial products. If an individual becomes involved in a dispute with her bank, forced arbitration prevents her from being able to bring the dispute before our court system, where it would be heard by a neutral judge and jury. Instead, the dispute must be heard by an arbitrator, who is often chosen by the bank.

Interestingly, Mr. Hirschmann’s written testimony to the Banking Committee begins with a paean to choice. He writes, “Choice empowers consumers” and argues that consumers should be allowed “to make their own decisions, based on accurate, understandable information and free from government dictates.”

And yet providing consumers with choice is exactly what any CFPB rulemaking limiting the use of forced arbitration would likely do. Forced arbitration doesn’t provide consumers with choice; by definition, it denies them a choice. Forced arbitration is itself an industry dictate, it’s by definition forced. So what are we to make of Mr. Hirschmann’s testimony? That choice is good for consumers unless the Big Banks decide it isn’t? That dictates are bad if they come from government, but perfectly fine if they come from industry?

But wait—there’s more.

Mr. Hirschmann spent much of his testimony arguing that arbitration actually provides better outcomes for consumers than does the court system. But if this were true, then why would the Big Banks insist on forced arbitration? Why not let the consumer decide? Perhaps the Chamber is fearful that if consumers—who are both individuals and small businesses—actually did have a choice between the court system and arbitration, many would choose the court system because the court system often provides better outcomes for consumers than does arbitration, as found by a CFPB study comparing the two fora.

While show trials aren’t designed to uncover the truth, as the truth is rarely what interests those who hold them, yesterday’s show trial against the CFPB at least had the merit of exposing the serious logical flaws and internal inconsistencies in the Chamber’s defense of forced arbitration. The Republican leadership may have already determined that the CFPB is guilty; unfortunately for them, their show trial instead proved that the Chamber is incapable of coming up with a serious defense of forced arbitration.

April 10, 2016 @ 10:52 am

Important for consumers to use credit unions and avoid the blatantly corrupt banks.

April 10, 2016 @ 6:27 pm

Once again the republicans reveal their total ineptitude in governing. They can’t even publicly exhibit a rigged committee hearing by choosing clueless witnesses, who completely make fools of themselves and their republican petitioners.

One would think after the republican failures to convince America of wrong doing in their Benghazi and Planned Parenthood investigations, that they would return to reality. Nope, the third time is the charm, or so they thought.

As my wife tells me, “there is no dearth of stupidity.”

All one has to do is to look upon their candidates for the presidency to realize that this is a political party in search of oblivion.

We can only hope that they are successful in that endeavor.

Maybe the Kochs, Adelson, Singer and such should demand their money back.

April 10, 2016 @ 6:29 pm

Forced arbitration in all contracts has become like a cancer. I even found it lurking in a 6 page contract a medical supplier required me to sign to receive needed medical supplies covered by Medicare. We need better governance than we are getting from Republican-led legislatures

April 10, 2016 @ 11:07 pm

Goodness… I hope these gentlemen have cleared their souls with God before they sold them…