Behind The Curtain: How Tom Donohue Says One Thing About Regulations but the Chamber Does Another

By David King, Intern at U.S. Chamber Watch

On June 22, 2016, U.S. Chamber of Commerce President Thomas J. Donohue gave a speech entitled “Financing America’s Economic Growth: How Robust Capital Markets Can Help Revitalize Our Economy” at the Nasdaq MarketSite in New York City. He began this speech by recalling that he previously spoke at Nasdaq in 2007, in the months before the Financial Crisis. He claimed that his advice then went unheeded. One is left to wonder exactly to what advice he is referring, as the Chamber has been a longstanding advocate of the type of deregulation that helped lead to the 2008 financial crisis. However, despite his dubious claims of prescience, Donohue offered us a second chance to dissect his well-worn platitudes that mask the Chamber’s aggressive deregulatory agenda.

Claim #1: “We want smart regulation.”

While Donohue may claim to seek “smart” regulations, the reality is that the Chamber almost never supports any new regulations. The Chamber does, however, spend its vast resources fighting against regulations intended to safeguard the American public. Most recently, the Chamber has opposed the Department of Labor’s fiduciary rule requiring money managers to act in their clients’ best interests as well as the Overtime Rule requiring that more salaried workers be paid for any overtime hours they work. Not to mention the Chamber’s epic fight against implementing the Dodd-Frank Wall Street Reform and Consumer Protection Act, including the Volcker rule banning commercial banks from engaging in proprietary trading activity with depositors’ money and rules proposed by the Consumer Financial Protection Bureau (CFPB), like limiting the use of forced arbitration clauses. Claiming that you’re for “smart” regulation when you almost never propose any is nothing more than a smoke screen to hide the Chamber’s reactionary, anti-regulatory agenda.

Claim #2: “If we take away the right to fail, we take away the right to succeed.”

Donohue’s defense of Wall Street ignores the fact that the new regulations born of the financial crisis do not take away the right for banks to fail; they merely attempt to eliminate the right to be too big to fail and therefore require taxpayer dollars for bailouts. While Donohue claims that these newly enacted regulations harm Main Street, the reality is that they shield Main Street from the enormous collateral damage that occurs when Wall Street’s casino games blow up as they did during the financial crisis. Credit for Main Street dries up when banks’ speculative activities run amok, something Donohue tries to gloss over in his speech.

Claim #3: “Too often rules are decided in the backrooms of Washington”

Talk about chutzpah. The Chamber is the nation’s largest lobbyist and is a habitué of Washington backroom deals. What’s more, Donohue has the audacity to demand greater transparency at various regulatory agencies despite the fact that the Chamber itself is quite opaque, refusing to disclose where its own money comes from. The Chamber received nearly $170 million in 2012 from just 1,500 donors. Not a single donor was disclosed. The Chamber’s very own head lobbyist, Bruce Josten, has stated “We never disclose funding or what we’re going to do.” If Donohue is serious about bringing transparency to Washington, then he should start with his own organization.

Claim #4: “I know a thing or two about the Post Office… Having it launch a banking operation is as dumb an idea as I have heard in Washington, a town full of dumb ideas.”

Postal banks are a fixture in many industrialized nations. The U.S. also historically had postal banking. Allowing the Post Office to expand its product line would provide much needed financial services to those who would normally go unbanked. This would be a great thing for consumers, particularly poor consumers who would benefit immensely from being able to avoid payday lenders and their astronomical interest rates. Of course, a Post Office bank would be a terrible thing for payday lenders, so naturally, the Chamber is against it.

Claim #5: “We’re not looking to pick winners and losers.”

Au contraire! Donohue and the Chamber’s agenda is very much looking to pick winners, and the winners in this speech, delivered in the heart of Wall Street are, not surprisingly, Wall Street banks as well as the rest of the financial services industry– the payday lenders, insurance companies, credit card issuers, and student loan issuers. Donohue’s agenda also creates losers, starting with small businesses and consumers who are harmed when the financial services sector is deregulated as Donohue wishes it to be.

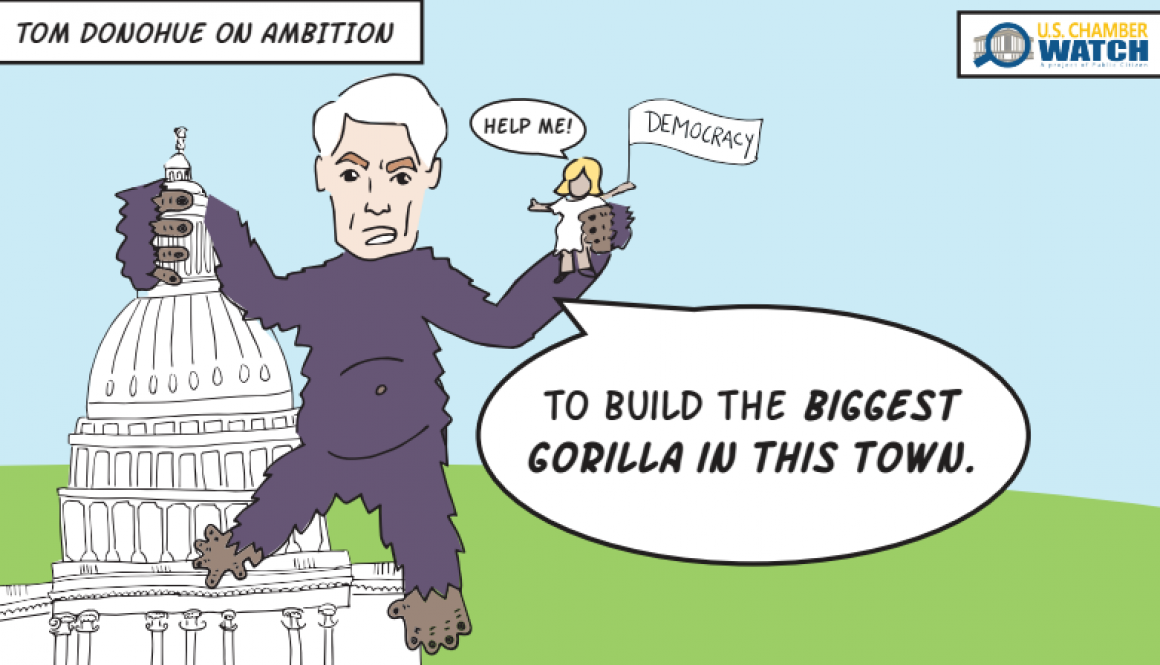

Donohue famously stated that he wanted to turn the Chamber into “the biggest gorilla in this town.” When it comes to the Chamber’s anti-regulatory agenda, Donohue is not so candid. While he may claim to support transparency and regulations and to act in the best interests of Main Street, that could not be further from the truth. Donohue and the Chamber’s M.O. should by now be clear: say one thing, do another.